Ytd federal withholding calculator

Click UPDATE YTD menu. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer.

Payroll Taxes Aren T Being Calculated Using Ira Deduction

This online calculator is excellent for pre-qualifying for a mortgage.

. YTD federal income tax withholding can be entered in the W2 box. Federal Income Tax Withheld NA. How often are you paid.

Flexible hourly monthly or annual pay rates bonus or other earning items. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Federal taxes were withheld as if I worked 80 hours in one week almost 40 more than shouldve been withheld for two pay periods.

The procedure is straightforward. 1547 would also be your average tax rate. YTD federal income tax withholding can be entered in the W2 box.

The tax calculator asks how much federal taxes am I paying ytd. ESmart Paychecks free payroll calculator is a paycheck calculator that can be used to calculate and print paychecks and paystubs. 1547 would also be your average tax rate.

The amount you earn. Non-Tax Deductions Non-tax Deduction Pay Type Hours Prior YTD. Feeling good about your numbers.

The information you give your employer on Form W4. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. Exemption from Withholding.

Federal Filing Status of Federal Allowances. Use this free tax return calculator to estimate how much youll owe in federal taxes using your You can use Form W-4 to reduce your withholding easily right now so you dont have to wait for the. See the IRS FAQ on Form W-4 to answer your questions about the changes.

FREE EDITABLE PAY STUB TEMPLATES IN PDF WITH CALCULATOR. Nevada Salary Paycheck Calculator. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

Prior YTD CP. Federal taxes were withheld as if I worked 80 hours in one week almost 40. Or the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

Be sure to have information regarding your income dependents and any additional items worth valuable deductions and credits including education expenses and itemized. Ytd Calculator And What Is Year To Date Income Calculator. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

This is the simpler method and it tells you the exact amount of money to withhold based on an employees taxable wages number of allowances marital status and payroll period. Now the question is why doesnt TurboTax allow you to enter modify federal income tax withheld on the Enter Payments Youve Already Made screen. Prior YTD CP.

Wage bracket method and percentage method. This is 1547 of your total income of 72000. There are two federal income tax withholding methods for use in 2021.

Updates YTD column paycheck date and payroll period ending date 3. It makes sense to be able to edit the tax withheld YTD here because thats the title of the screen. State W-4 Information.

The IRS hosts a withholding calculator online tool which can be found on their website. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Federal Income Tax Withheld.

Raise your AC to 78 from 3pm - 10pm. Use that information to update your income tax withholding elections on our Services Online retirement tool. Enter the year-to-date income in the YTD box then choose the start and finish dates and click outside the box or the calculate button.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Businesses impacted by recent may qualify for extensions tax relief and more. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Paycheck Withholding Calculator Statement of Account. 2020 brought major changes to federal withholding calculations and Form W-4. Here is an example of using the YTD calculator.

Computes federal and state tax withholding for paychecks. IRS tax withholding calculator question. 1960s zippo lighters for sale on ebay.

Urgent energy conservation needed. The amount of income tax your employer withholds from your regular pay depends on two things. The tax calculator asks how much federal taxes am I paying ytd.

This online calculator is excellent for pre-qualifying for a mortgage. Please visit our State of Emergency Tax Relief. This increases your tax bill and your marginal tax rate.

Check if you are Non-Resident Alien. Your taxes are estimated at 11139. For help with your withholding you may use the Tax Withholding Estimator.

Estimate how much youll owe in federal taxes using your income deductions and credits. Computes federal and state tax withholding for paychecks Flexible hourly monthly or annual pay rates bonus or other earning items. If you adjusted your withholding part way through 2021 the IRS recommends that you check your withholding amounts.

At higher incomes exemptions many deductions and many credits are phased out. For employees withholding is the amount of federal income tax withheld from your paycheck. If you want to add in to the monthly and yearly earnings check the Add to total box.

NA 000. Your income puts you in the 25 tax bracket. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

10 12 22 24 32 35 and 37. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Payroll Calculator Free Employee Payroll Template For Excel

Oracle Workforce Rewards Cloud 20b What S New

What Does Ytd On A Paycheck Mean Quora

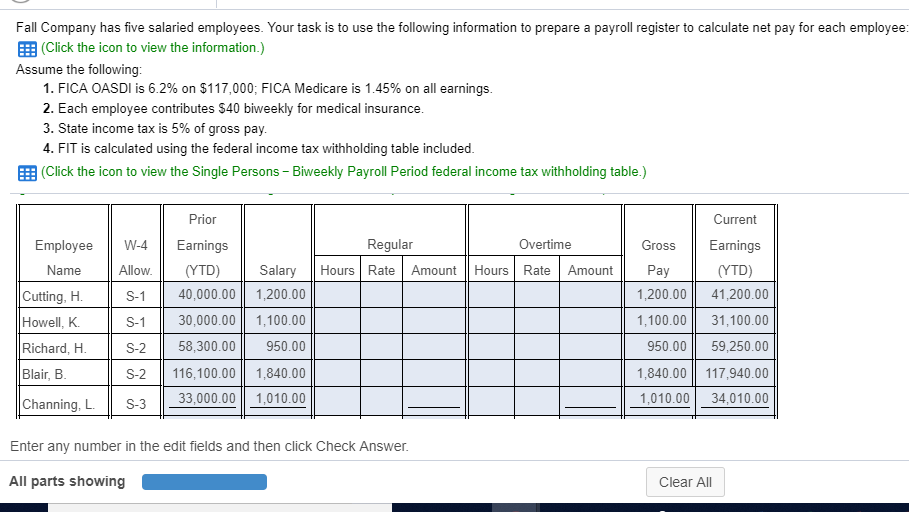

Fall Company Has Five Salaried Employees Your Task Chegg Com

Hrpaych Yeartodate Payroll Services Washington State University

So I Use A Website To Calculate The Tax That Should Be Taken Out Of My Checks If I Follow This Should I Be Fine R Doordash

Us Enter Year To Date Ytd And Current Amounts Wagepoint

Peoplesoft Enterprise Global Payroll For United States 9 1 Peoplebook

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Calculator Free Employee Payroll Template For Excel

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

Decoding Your Paystub In 2022 Entertainment Partners

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

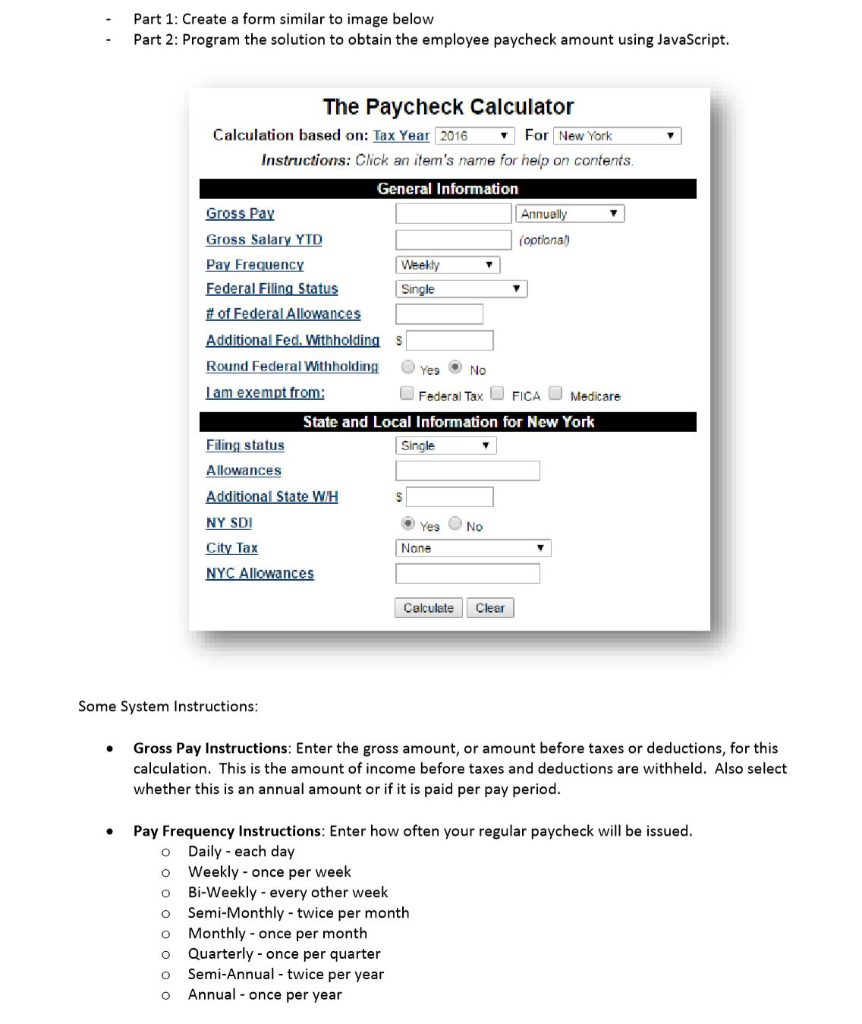

Filing Status Instructions Select Your Filing Chegg Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto