Roth 401k rmd calculator

How to calculate RMD when one spouse is more than ten years younger and. An individual can put 6000 into a Roth IRA per year or 7000 if over 50 in 2021 and 2022.

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

For most people converting is.

. Your actual qualifying contribution may. The Uniform Lifetime Table lists Hannahs distribution period as 256 years. The RMD rules also apply to.

The Most Accurate Roth Conversion Calculator Youll Find Key Points Its possible--and sometimes desirable--to convert a traditional IRA to a Roth IRA. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. A required minimum distribution RMD.

You may also use the IRS. The terms of Roth 401 k accounts also stipulate that required minimum distributions RMDs must begin by age 72. For example if your retirement account has one million dollars.

RMD Account balance as of December 31 Life expectancy factor. If you are in a 28000 tax bracket now your after tax deposit amount would be 300000. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more.

Use Bankrates RMD Calculator to calculate these mandatory distributions. You must take your first RMD for 2018 by April 1 2019. See the worksheets to calculate.

Calculate the required minimum distribution from an inherited IRA. The IRS provides one here. That distribution age is 70½ if you reached that.

RMD Account balance as. Even if you are still working you must take your first RMD from a traditional IRA SEP IRA or SIMPLE IRA by April 1 of the year after the year in which. The RMD formula is.

Dividing her balance by her distribution. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to.

Her 401 k had a balance of 250000 on December 31 2020. The rules are slightly different from those for your own account. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Youll need the deceased persons. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. Luckily you can use a simple calculator to estimate how much you will need to take out.

In contrast you can put 19500 into a Roth 401 k for 2021 and 20500 for 2022. FINRA RMD Calculator The FINRA Required Minimum Distribution RMD from a traditional 401 k or IRA is based on your age and account value. You will save 14826875 over 20 years.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. The RMD rules apply to all employer sponsored retirement plans including profit-sharing plans 401 k plans 403 b plans and 457 b plans. It is mainly intended for use by US.

401k Roth 401k vs. You will take subsequent RMDs on December 31st annually thereafter as will be discussed below. The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and costly mistakes.

RMD Rules for Traditional IRAs. 401 k RMDs are calculated by dividing the account balance in your 401 k by what is called a life expectancy factor which is basically a type of actuarial table created by the. 6650 month in retirement Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions.

Sometimes FMV and RMD calculations need to be adjusted after December 31.

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Rmd Table Rules Requirements By Account Type

The Ultimate Roth 401 K Guide District Capital Management

Required Minimum Distribution Calculator Estimate Minimum Amount

Required Minimum Distribution Rules Sensible Money

What Is The Required Minimum Distribution From Retirement Accounts The Heritage Law Center Llc

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Required Minimum Distributions For Retirement Morgan Stanley

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Rmd Calculator Required Minimum Distributions Calculator

How To Calculate Rmds Forbes Advisor

Solo 401k Rmd Questions And Answers

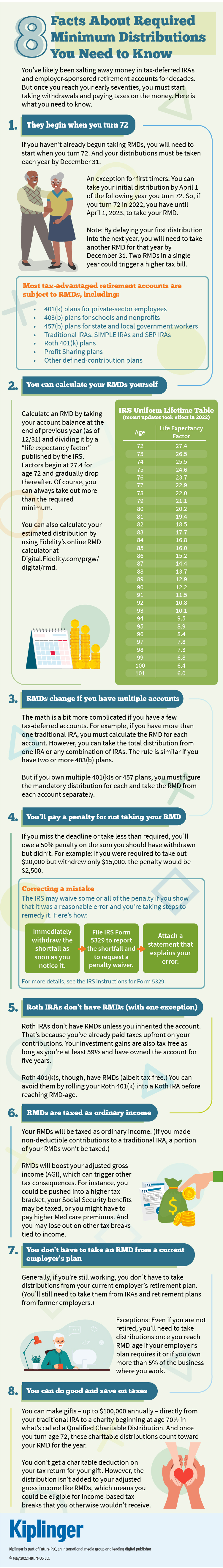

8 Facts About Required Minimum Distributions You Need To Know

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal